Category: Uncategorized

Janet To the Rescue?

Last month, the US Congressional Budget Office (CBO) released “An Update to the Budget and Economic Outlook: 2024 to 2034” which contains its baseline projections of what the US federal budget and the economy will look like in the current year and over the next 10 years if laws governing taxes and spending generally remained unchanged.

Unlocking Opportunities in Australia’s Credit Market

With aggressive monetary stimulus well behind us, the first half of 2024 is starting to show some stark changes in credit markets from this time last year. Although liquidity is slowly leaving the system, pricing would indicate this isn’t happening uniformly as capital is being reallocated amongst credit classes. This note provides recent observations across public and private credit markets and offers insights for investors considering the space.

The Attraction of Asia

Carrara is globally focused and currently sees Asia as the most attractive investment destination in the world. We also think that increased exposure to the region can offer investors portfolio diversification, exposure to the strongest economic region in the world and access to global leaders in key industries.

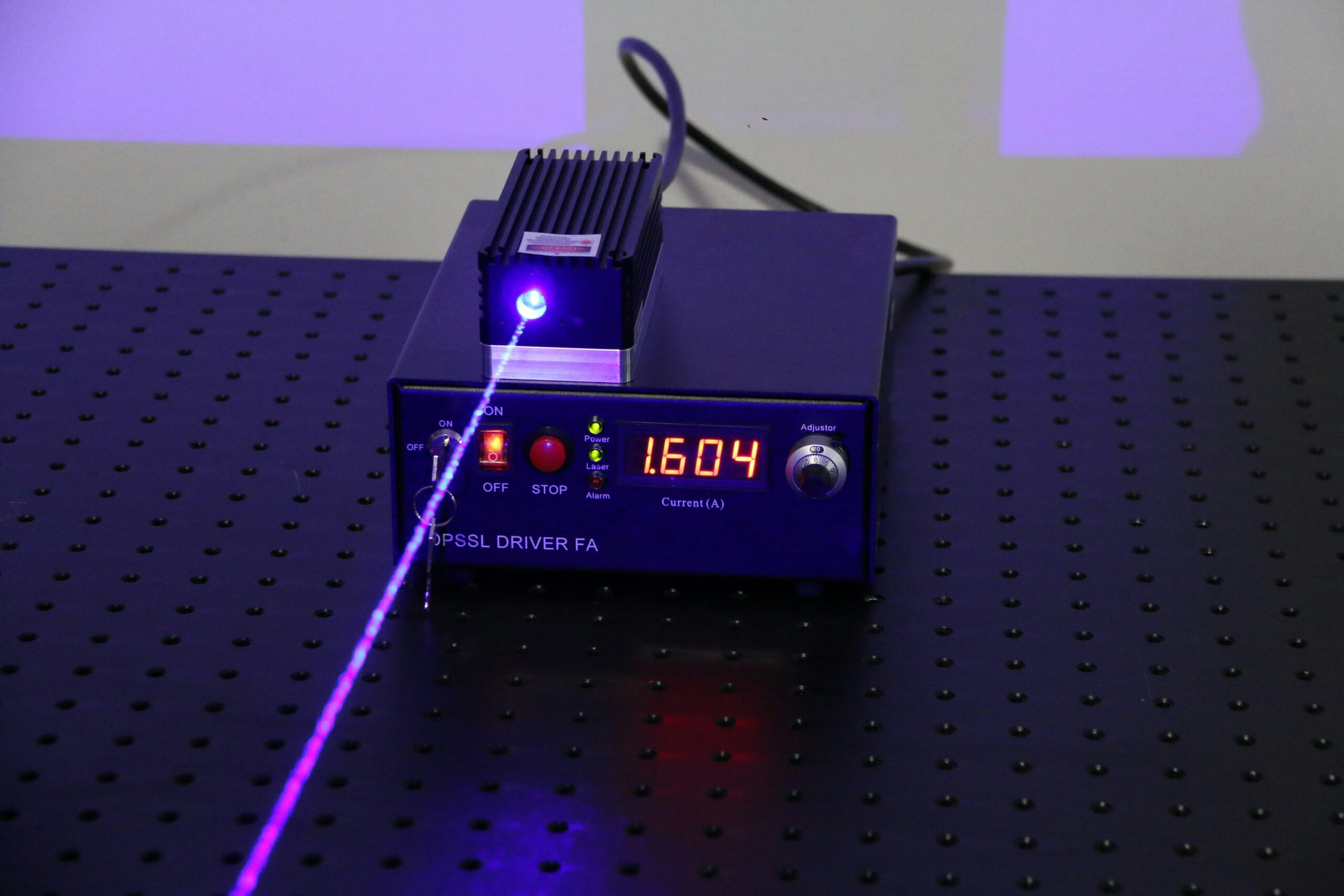

Investing in the Semiconductor Supply Chain

The purpose of this report is to provide a detailed overview of the semiconductor supply chain to help investors better understand of the different segments and components that go into making a chip. Additionally, we would like you use this as an opportunity to demonstrate how and where Carrara Capital are investing to take advantage of this attractive opportunity.

Private Credit. For Better, For Worse

To have a thorough understanding as to why a credit return profile is asymmetric, we look to understand the nuances underlying credit exposures.

Is It Time to Look at Private Markets?

2023 was a difficult year across the private markets space with many companies finding funding difficult to secure, despite apparent business success. This has led to more rational valuations and a willingness for founders to offer deals to give their businesses addition time to realise their potential.

While we don’t expect 2024 to be a boom year, we are seeing some excellent investment opportunities and think the current environment is ripe for investors willing to do their due diligence.

China’s Footprint in the Global ‘Critical Minerals’ Industry

The resurgent dominance of China in the global ‘critical minerals’ supply chain is a growing concern for western countries. Until alternate supply chains can be developed – likely a 10+ year challenge – China holds significant and increasing leverage over the US and Europe. The scale of the impact on global markets is both underappreciated and rapidly unfolding, yet it is crucial for investors to understand the full landscape to make informed decisions.

Has the can been kicked far enough?

Debt is now driving US economic growth and without government deficits, would be in a deep recession. Metaphorically speaking, like a patient overcompensating with pain medication, the US has found themselves addicted to debt.

Is It Time to Re-Enter Chinese Equities?

Is the current ‘fear’ for Chinese equities warranted or does it present an attractive buying opportunity? Stepping back from the political rhetoric and negative news flow, we focus on the financial data underpinning China’s 5 leading technology companies compared to their US peers.

Great Opportunities Developing in Credit Markets

The following is intended to provide a current overview of the Australian credit landscape and the opportunities which Carrara is currently seeing and expects to continue into the first quarter of next year.