China’s Third Plenum has had limited coverage in the Western financial media despite containing what Carrara considers several significant policy shifts – especially given the impact that the Chinese economy has on global markets.

Held every 5 years – this year in Beijing from 15th to 19th July – was the 20th such meeting. The third Plenum is a one of the most notable events in the Chinese economic calendar and is when major decisions on the country’s long-term social and economic policies are made. The outcomes of the plenum are summarised in the ‘Communique’ that follows that meeting, which is used as economic blueprint for the ensuing years.

This note breaks down the event’s policy agenda into the key areas that may have an impact on global markets and hence investment portfolios.

President Xi Jinping’s Current Assessment of the Chinese Economy

President Xi outlined several key issues that are negatively impacting China’s economy:

Even though the Chinese economy has developed at an unprecedented pace over the last three decades, President Xi’s statement via the communique and concluding speech makes it clear that the job is not finished and that there is an urgent need to continue modernising the Chinese economy and to shift away from the capital-intensive, construction (property and infrastructure) led growth model that has been in place since the 1980s. Many Western based financial commentators appear to have missed the importance of this pivot towards a quality over quantity growth model, with a clear focus on technology and innovation.

Key Policy Focuses

Chinese Society

The phrase “democratic reform” was mentioned multiple times throughout President Xi’s speech, and the focus on developing a “sound social security system to serve people in flexible or rural employment” suggests the Politburo is increasingly aware of the need to improve the lives of all Chinese citizens to maintain their political system.

To meet the significant challenges of China’s ageing population over the next few decades, President Xi discussed the Politburo’s goal to strengthen the healthcare and elderly care systems, and gradually raising the statutory retirement age to encourage people to work longer. Finally, his speech had a strong emphasis on building a law-based society that treats all citizens equally and is committed to “cracking down hard on illegal and criminal activity.”

President Xi clearly understands his tenure rests on the efficacy of “Democracy with Chinese Characteristics” – to maintain a “harmonious society”. Every citizen, not just the wealthiest, must benefit from China’s rising economic growth. Providing financial support for the unemployed, strengthening the rights of employees, and ensuring equality through a strong legal system that protects every citizen will be essential if China’s version of “democratic values” (clearly different to those in the west) is to be successful.

Restructuring the Tax System

President Xi outlined plans to improve China’s macroeconomic governance system including reforming its fiscal spending and tax collection processes. Its new policy aims for a ‘clear division’ of central and local responsibilities to provide a better match between fiscal revenues and expenditures at the local level. This should allow local governments to have more autonomous fiscal capacity and reduce local governments heavy reliance on property sales and debt funding to generate fiscal revenue.

The traditional model, which has led to local governments accumulating excess property related debt, has been recognised as a significant roadblock in President Xi’s plan to shift China away from a capital-intensive growth model. Once implemented, local and provincial governments should have a greater share of federally collected taxes, which can be specifically directed towards local entrepreneurship in President Xi’s targeted areas of innovation and technology to drive future GDP growth.

School and Tertiary Education System

Aligned with the shift towards high-quality development, President Xi outlined policies to reform the education system, emphasising the need to improve science and technology training in schools and universities, and “making extraordinary moves to plan for disciplines and majors that are in urgent demand”. The policy more clearly defines the roles of universities and national research institutions in science and technology research, and reinforces financial support for private, high-tech companies as key drivers of China’s efforts to close the technology gap with the West. Finally, President Xi discussed intellectual property reform that “grants researchers corresponding rights over their outputs”, while identifying and financially supporting young entrepreneurs within the university system.

The closer alignment of education and research with China’s innovation goals is a clear response to the research and development dominance of US and European companies, particularly with respect to leading-edge technologies like AI (Artificial Intelligence). Despite much development, Shenzhen has not yet achieved ‘Silicon Valley of the future’ status, and matching Western entrepreneurial capabilities remains some years away. However, these policy initiatives should facilitate the path forward and may see China reach their goals sooner than previously expected. The granting of patent ownership to researchers within state institutions may also help by encouraging overseas-based Chinese scientists developing innovative technologies with a substantial financial incentive to return to China and continue their research.

Xi’s emphasis on research and intellectual property, in addition to providing financial and policy support for both state and private institutions is particularly positive for Hong-Kong and Shanghai listed technology leaders, such as companies such as Alibaba, Tencent and JD.com. Increased researchers and developers, new technological advancements and increased potential markets throughout Asia that can only benefit their business and potentially be a shareholder friendly use for excess cash on their balance sheets.

International Trade

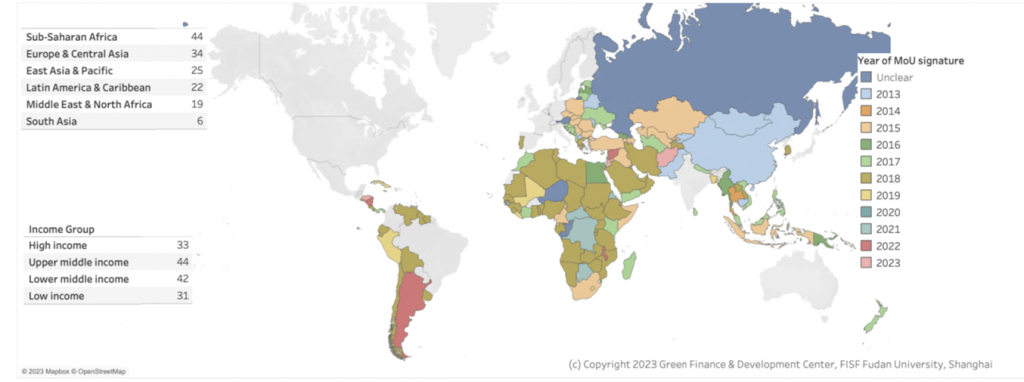

President Xi outlined a commitment to deepen trade and investment within the 150 countries that are members of China’s Belt-and-Road (BRI) initiative shown below. Particularly in an era of Western isolationism and protectionist rhetoric, this direction should sit well with fans of free trade.

On the rising issue of large trade imbalances between China and most BRI members, President Xi also committed to provide greater trade access for BRI members to the Chinese domestic economy and its 1.6 billion consumers. However, at the same time he also singled out the US and Europe, outlining plans to “strengthen mechanisms for countering foreign sanctions, interference, and long-arm jurisdiction”.

By focusing both on increasing trade to BRI countries as well as addressing imbalances, Xi showed another shift in rhetoric, away from the wolf warrior diplomacy of the 2010’s and towards a more pluralist, multipolar world.

China has noted that it will continue to direct trade towards BRI/BRICS+ aligned nations, with the share of higher value exports (technology and industrial products) accelerating over the next 5-years. His comments on addressing foreign sanctions and interference are directed towards accelerating China’s shift towards facilitating trade in assets other than US dollars and continuing to reduce its US dollar denominated foreign reserves.

The consequences of China shifting trade away from the US and Europe in favour of BRI/BRICS+ nations can be inflationary for the US, Europe and other Western nations that implement trade barriers. With China currently producing 1/3rd of global manufactured goods, investors need to be especially careful to avoid underestimating the time and capital it will take to rebuild local manufacturing to offset Chinese imports, which dominate many industries today.

Global Security

President Xi also touched upon an increasingly fragile geopolitical environment, stating that “momentous changes of a magnitude not seen in a century are accelerating across the world, regional conflicts keep cropping up, global issues are becoming more acute, and external attempts to supress and contain China are escalating”. He outlined China’s plans to continue to strengthen its national defence and armed forces to promote security in “neighbouring regions”.

Rightly or wrongly, emerging superpowers throughout history have built up substantial military capabilities to project economic power and protect their global trade routes. As a global superpower, China is rapidly expanding its military footprint in response to the growing threats that it perceives from the US and its military partners. President Xi’s reference to promoting security in “neighbouring regions” certainly are directed at what China perceives as US efforts to agitate dissent between China and nations with boundaries in the South China Sea.

The US Navy has long been the security guarantor for global trade and leading up to a US election between the two most isolationist candidates in a century, China recognises the security risk in a rapid a shift away from Pax Americana. Despite what many might interpret as sabre-rattling, China’s behaviour may be more defensively orientated rather than based on aggression, particularly with respect to protecting trade routes.

Conclusion

Markets shrugged off the outcomes of China’s Third Plenum two weeks ago, however we thought the statement following the conclusion of the Plenum highlighted a commitment from the Chinese government to adopt a new growth model for the country to reach its long-term targets. The increased focus on education and support for those more vulnerable in its society is a positive and something which many other developed nations are struggling with. Likewise, while many major nations are implementing trade barriers, China is actively trying to facilitate trade – albeit with its neighbours and BRICS/BRI partners instead of the US and Europe.

Domestically, the big question for China is whether it can successfully execute this plan. We have seen some early success in its recent record of high growth and innovation in industries focused on electric vehicles, clean energy, and e-commerce. If it can achieve its goal of becoming a more “democratic” society while at the same time becoming a global leader in research, education, and high-quality technology, the opportunity for investors could be significant. Global investors, who collectively have minimal exposure to Chinese equities, should closely monitor China’s economic success given the extreme undervaluation of Chinese equities verses other global markets.

Globally, the big question is how the US, Europe and their allies will react to China’s reforms and ongoing increase in power. If all parties can coordinate and work together, then the world can enjoy the prosperous environment that it has for the past few decades. If it cannot, and global trade is further disrupted by the implementation of tariffs and trade barriers, then there is a real risk that China becomes increasingly isolated from the US and Europe as a trade partner.

This is one of the key reasons why China is deepening its relationships with its BRICS+/BRI partners. Increasing bi-lateral trade in the region provides them with greater trade access to its domestic economy and 1.6 billion consumers. One could make a compelling argument that were trade to completely dissolve with China, Europe and countries including Australia would be much more impacted than China itself. However, substantial job losses in their export-oriented companies would need to be very carefully managed by the Chinese government.

At Carrara, we spend a great deal of time trying to understand China, both its strength and weaknesses, and the investment opportunities it is producing within its borders and the greater Asian region. I was fortunate enough to build an investment business in China and have visited over 100 times in my career. Hopefully as a result, our insights and investments in China and the Asian region will be financially rewarding for our investors over the coming years.

Citations & Footnotes

[1] Green Finance & Development Center, FISF Fudan University, Shanghai