Last month, the US Congressional Budget Office (CBO) released “An Update to the Budget and Economic Outlook: 2024 to 2034” which contains its baseline projections of what the US federal budget and the economy will look like in the current year and over the next 10 years if laws governing taxes and spending generally remained unchanged.

US Deficits

The projections are summarised below [1]:

$1.9 Trillion

99% of GDP

$6.8 Trillion

$4.9 Trillion

The $1.9 trillion deficit is an increase of $408 billion (or 27%) more than the $1.5 trillion deficit that the CBO estimated in February 2024. The fact that spending expectations have blown out by such a large amount in less than 6 months should be a concern to any reader and investor.

According to the CBO, the US budget deficit will equal 7.0% of gross domestic product (GDP) in 2024 and 6.5% of GDP in 2025. By 2034, the deficit is expected to be 6.9% of GDP – significantly more than the 3.7% average deficit over the past 50 years.

While this government spending has provided vital stimulus for the economy and is a key reason why the US has been able to avoid recession thus, it has created a potentially far greater issue given the resultant US debt burden.

US Debt Levels

The problem for the US is that its total debt is now a staggering ~$34.5 trillion according to U.S. Department of the Treasury Fiscal Service or ~122% of GDP. This is expected to grow to $56.9 trillion or over 140% of GDP by 2034. Only this month, the International Monetary Fund (IMF) has warned that the rapidly growing US public debt must be “urgently” addressed lest it cause major problems for the global economy and its financial system.

The US has taken advantage of the fact that the US dollar (USD) is the global reserve currency – there is both global dependency and a lack of viable alternatives. It has spent seemingly without restraint acting as if the US Treasury can simply print money (or credit bank accounts) to fund its liabilities.

“The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost”

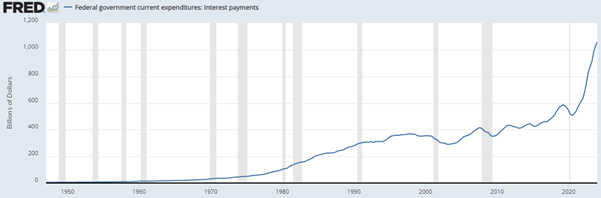

Bernanke was not quite right. Eventually there is a cost and for the first time the USD’s role and their country’s economic future is being questioned by many economists and investors. The cost of servicing the debt is now becoming problematic both in absolute and relative terms. The estimated annualised interest payments on the US government debt surpassed $1 trillion at the end of October 2023 and now sits at $1.06 trillion annually. This has the potential to crowd out a significant portion of the private sector as funds are sought to service the deficit.

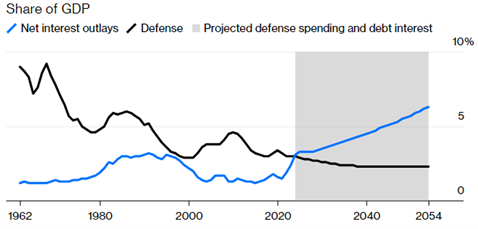

The growing problem is not just an academic economic discussion, but a geopolitical concern as well and one which could significantly weaken the US’ global leadership. In a Bloomberg article renowned Monetary Historian Niall Ferguson pointed out that according to the CBO, US interest repayments will be 4.6% of GDP by 2041 verses an average of 1.8% of GDP between 1962 and 1989. As the chart below shows, this is expected to dwarf what the US spends on defence at a time when the world has arguably become more precarious and divided.

Enter Janet Yellen

Typically, the US Treasury funds its debt liabilities predominantly with 10-year bond issuance, but a major problem for the US is that foreign buyers of its 10-year bonds (namely China and Japan) is shrinking. China’s holdings of US Treasury Securities has fallen from ~$1.26 trillion in 2014 to ~$767.4 billion in March 2024 – which is a decrease of almost 40% over the last 10 years. With a dearth of buyers, the US Treasury, led by Janet Yellen, has started funding the debt with short-term Treasury bills instead of the usual 10-year bonds.

This has been an expensive exercise given the spread between 90-day Treasury Bills and10-year yields but one that has worked in the short term. However, such a move was arguably necessary given the supply/demand dynamics for 10-year bonds and the potential for debt servicing to have driven US 10-year yields much higher. This could have put a great deal of pressure on bond markets, the banking system and equities. Yellen is no doubt wanting to avoid the situation that the UK found itself in in September 2022, when investors punished UK bonds as a result of then Prime Minister Liz Truss’ spending plans and the new debt issuance that would be required to pay for it. UK 10-year Gilt yields increased from 3.17% on the 15th of September to 4.50% on the 27th of September.

With everyone invested in equities riding high on US Technology, perhaps they should be showing some appreciation towards the actions of Janet Yellen – preempting a dangerous situation, supporting the system and protecting investors from a potentially major downturn.

In the book ‘Fooled by Randomness’, author Nassim Nicholas Taleb points out that we largely focus on the path that eventuated and not on alternative paths that could have happened with equal likelihood. Despite a major downturn not occurring, we at Carrara were aware of and prepared for the alternative path should it have happened.

Moving Forward

While recent months have been placid with a low volatility grind up in equities and house prices, this may not be sustainable.

- US debt and federal deficits are not being reduced and both potential Presidential candidates appear to be favoring ongoing large deficits over the coming years which will likely make the problem worse,

- The evolving multipolar world almost guarantees that foreign buyers for Treasuries are not coming back in a hurry unless interest rates are much higher to reward them for the increased risk,

- The incentive to invest in US Treasuries domestically is low given term premium in US 10-year bonds is currently negative (suggesting overvaluation),

- Inflation expectations in the US remain above the Fed’s target given higher services inflation, sticky employment cost index and renewed supply chain costs with freight costs reaccelerating,

- The development of a multipolar world may be inflationary given the reshoring of production and likely higher tariffs across many parts of the world, especially the US and Europe.

The likely outcome in our mind is that the US will have to ‘turn Japanese’ and either re-start quantitative easing (QE) and/or have to undergo some kind of yield curve control – if the issuance of short-dated Treasuries has not already done this to some degree. Without these tools being used, it seems unlikely that the US can stabilize bond markets at manageable levels given that rising debt repayments continue to drive deficits higher, and inflation remains stickier than previously expected. A recession would typically reset an economy, but modern politics does not support recessions and politicians such as Australia’s Paul Keating who famously described the 1990s as the ‘recession we had to have’ have all but disappeared from leadership. It is much easier to keep spending and accumulating more debt until something eventually breaks.

Impact on Investments

In the near-term the ‘goldilocks’ environment can continue for markets with risk assets advancing, yields remaining manageable and people believing a US economic soft-landing is possible, but as we saw in the UK with Liz Truss or more recently with the French election, the environment for investments can change rapidly. We need to 1) be able to identify problems before they occur and 2) be able to manage portfolios with some insulation of risk. We do not know when the turning point will come, but we would suggest that now is not the time to be ‘all-in’ on equities without the ability to hedge risk or protect your portfolio when needed.

Equities can continue to rally, but with arguably more potential risk over the coming period given the narrow breadth of the US equity market, political uncertainty, high valuations, and generally weaker economies across most of the world. We think investors need to be very targeted with how and where they take risk both from an asset class, sector, and geographical perspective. We may be biased, but we would argue that the environment is one that should suit active versus passive management moving forward. We also think an absolute return approach is appropriate as well – this has not worked well over the past 12-18 months given equities have moved higher largely irrespective of valuations and fundamentals, but we think this is unlikely to continue into the medium and long term.

Commodities and real assets should be beneficiaries of this environment as infrastructure spending continues, onshoring advances and many key commodities experience supply demand imbalances. A multipolar world is supporting precious metals for the first time in many years as central banks recycle US dollars into non-US assets and prefer to hold gold over financial assets domiciled in foreign countries which could freeze or confiscate them. This is likely to continue if tensions increase and China and the US further diverge. Lastly, if US debt continues to balloon, the US dollar would also be expected to weaken due to excess supply and a potential loss of confidence. This would likely benefit commodities and real assets and prompt the start of a new commodity super cycle.

Conclusion

At Carrara we take a macro view of markets and risk and a thematic and fundamental approach to investing. We are considerate of risk and the inner works of the market with the aim to be well prepared for surprises when they come along. In terms of our current themes, we are invested across Asian consumer growth, the semiconductor supply chain, AI and its uses, commodities and energy demands and the development of a multipolar world.

We would be happy to discuss any macro views or thematic investments in more detail should you wish to gain risk conscious exposure to these opportunities. Please contact us for more information.

Citations & Footnotes

[1] Congressional Budget Office – An Update to the Budget and Economic Outlook; 2024 to 2034

[2] US Department of the Treasury, Fiscal Service (fred.stlouisfed.org)

[3] U.S. Bureau of Economic Analysis (fred.stlouis.org)

[4] Congressional Budget Office (via Bloomberg.com)

[5] Board of Governors of the Federal Reserve System (US) (fred.stlouis.org)