Recent discussions about the merits of public versus private credit have often mirrored debates over preferences for beef versus lamb or pizza versus pasta—personal, varied, and circumstantial. While managers in either camp advocate for their domain, the distinction between public and private credit is not always the most pertinent factor for investors. Focusing solely on this division may miss the broader picture of investment risks and opportunities.

One characteristic that almost always holds is that public credit, ceteris paribus, is more liquid than private credit. Given this, an identical private position will trade at a wider spread due to an illiquidity premium, however the credit landscape is rarely that simple and there are a multitude of characteristics and risks that influence the pricing of a credit instrument.

Each credit investment, private or public, has its own peculiarities and each investment’s risk components (asset exposure, documentation, regulatory landscape, taxation consequences etc) must be thoroughly understood. It is for this reason that most credit managers are specialised, perhaps in commercial real estate, securitisation, leveraged finance – and typically between the public or private markets of these underlying sector types.

As with asset sectors, the public and private credit markets certainly have a cyclical nature to them – however they do not necessarily move in tandem. For example, in the early part of 2024, spreads in primary public issuances contracted markedly and have remained compressed, however during the same period private market spreads did not exhibit the same compression. Assuming the risk between these two markets is correlated, one would conclude that, as we stand, private positions represent comparatively better value against public credit compared to a year ago.

Australia's Credit Market in 2024

As we reach the close of 2024, the credit market landscape in Australia has experienced notable changes. Over the past two years, there has been a gradual deterioration in credit markets across the country, combined with a crowding of both public and private credit supply. This has created a more challenging environment for investors seeking to generate yield at a given level of risk.

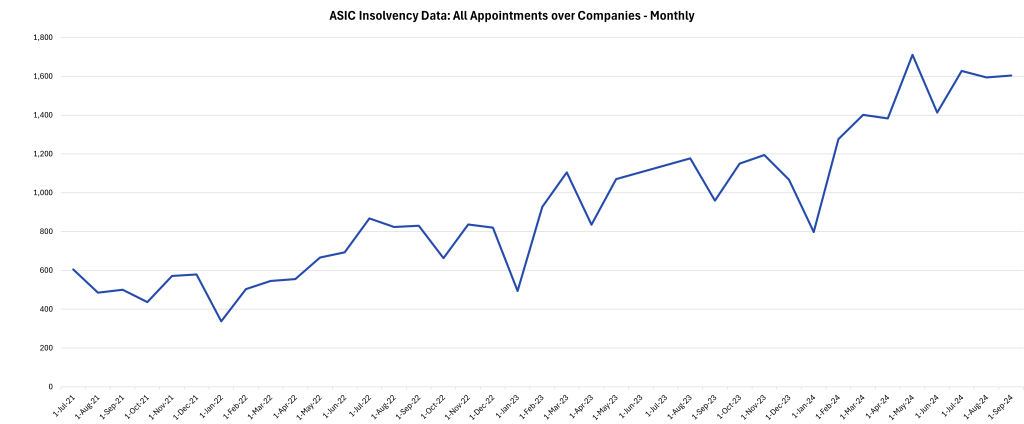

Recent data from ASIC’s insolvency statistics provides a clear indication of the steady deterioration across; court appointments, administrations/DOCAs, liquidations and restructurings, as seen in the chart below.

The implications of these trends are particularly relevant when assessing public versus private credit investments:

Being blindly constrained to one mandate, be it, asset class, sector or market, restricts the ability to profit when cycles turn or present a risk-factor arbitrage. This is why heavily constrained mandates are measured against a tight benchmark – rather than returning the best opportunity at a point in time.

Private and public investments are rarely offered together, this is true for both credit and equity. There simply aren’t that many managers with the requisite breadth of experience to adequately cover both classes of assets and their many and varied characteristics.

The recent rise in insolvencies and stress in the market serves as a reminder that effective risk management, thorough due diligence, and a diversified approach are essential to achieving optimal outcomes. Being able to allocate more broadly can allow more of an investor’s preferences to be met. A mix of public and private credit investments can allow for a good portion of one’s portfolio to be liquid with confidence of pricing transparency, whist being able to access the enhanced return, relative to the risk, that private transactions can offer.

If you would like more information about our investment views in the current market climate, Carrara’s approach to credit investment, or how you could become an investor, please contact us.