The world is in the midst of a technological transformation that will rival the industrial revolution, with Artificial Intelligence (AI), Clean Energy Solutions (CES) and the Internet of Things (IOT) all being developed at the same time.

While investors have some exposure to companies around the globe taking advantage of these themes, it is also likely that:

- They are overweight domestic markets – property, bonds, and equities,

- Their global exposure is largely focused on developed markets such as the US, Germany, or the UK, and

- They are missing out on the significant opportunity beneath the surface by prioritising the often-overvalued big names in US markets.

To counter these issues, investors may want to consider gaining exposure to these themes and building a more robust and diversified portfolio. If you want to invest in:

- The world’s largest EV Manufacturer

- The world’s largest mobile phone brand

- The world’s largest technology-driven food delivery business

- The world’s most dominant semiconductor manufacturing company

- The two largest semiconductor memory manufacturers

Then you may need to invest in Asia.

Asia's Growth Potential

Asia is the most populous geographical region in the world with over ~4.75 billion people, representing over 60% of the world’s total population. Asia’s population is expected to grow further to 5.25 billion people by 2055[i].With 17 ‘megacities’ – populations exceeding 10 million people – in China alone, in addition to the vastly populated metropolises of Tokyo, Mumbai, Delhi, Karachi, Jakarta, Hong Kong, Singapore, and Seoul, to name a few, the tremendous consumption potential in the region is almost beyond comprehension.

Importantly, much of this population is moving into what is considered the middle class. ~90% of the 2.4 billion people in the world entering the middle-class live in Asia.[ii] Further, it is not only the middle class that is growing in the region with Credit Suisse’s 2022 Global Wealth Report showing that China and Japan had more millionaires than any other country on the planet outside of the US.

These population dynamics continue to create the bulk of global growth, with the research-house Economist Intelligence Unit estimating that Asia will contribute 60% of global real GDP growth in 2024, and Asia’s annual GDP growth is expected to be much larger than traditional Western developed markets. According to Morgan Stanley, Asia’s (ex-Japan) real GDP is expected to by 4.5% per annum from 2023 to 2025[iii]. India is expected to grow by ~6.5% during this period and China by ~5%. This compares with G10 countries which are forecast to grow by just 1.4% in 2024 and 1.3% in 2025.

In 2023, the United Nations Conference on Trade and Development’s World Investment Report (UNCTAD) estimated that Foreign Direct Investment (FDI) in Asia accounted for about half of global inflows in 2022 (around $662 billion), and it is likely this high level of growth will be maintained in the years to come[iv]. FDI inflows continue to grow across the region and is driving new investments within countries such as Japan, Korea, China, Taiwan, and India. Technology driven industries including electric vehicles, semi-conductors, battery development, medical and pharmaceutical technology, and clean energy are the biggest recipients of this inbound foreign investment.

Interestingly, export restrictions enacted by the US, Japan and Europe on semiconductors and related manufacturing equipment, has seen China accelerate its own investment into the sector. Backed by central government funds, China has invested over US$40bn into its domestic semiconductor sector since 2014, with a new US$40bn 5-year investment plan expected to be announced this year.[v]

Electric Vehicles have become a key growth sector for greater Asia, with China producing over 50% of global EV’s during the past 5 years. Investment in other parts of Asia is growing, with EV manufacturing plants being established in Thailand and Indonesia, while battery materials plans are being built across South Korea and Indonesia. Examples of FDI flows across the region include [vi]:

- China’s BYD announced plans in early 2024 to invest US$1.3 billion to build an EV factory in Indonesia.[vii]

- Korea’s Hyundai has committed to invest US$4bn into India over the next decade to launch new EV’s, charging stations and battery assembly packs. With 15% local market share of the Indian auto market, it is also planning to IPO its Indian operations on the Bombay stock exchange.

- United Arab Emirates-based Ocior Energy plans to invest US $5 billion to build a green hydrogen and ammonia production facility in India.

Reforming the Asian Investment Narrative

Many investors have questioned Asia as an investment destination, particularly following the Asian Currency Crisis, which started in July 1997 and lasted until 1999. However, the positive changes adopted in their economies, which included more flexible exchange rates, an overhaul of financial sector regulation and supervision, lower private sector debt, and the development of broader capital markets have provided stability to the region and led to a reduction in external vulnerabilities including an over-reliance on the US Dollar. Growth across the region accelerated from December 2001, following China’s admission to the World Trade Organization (WTO), leading to an enormous boost in the regions manufacturing. Termed the fastest sustained expansion by a major economy in history by the World Bank, the impact of China’s rise on living standards, private wealth, and the knock-on effects across the region are nothing short of miraculous.

The progressive changes implemented over the past few decades define the start of ‘modern’ Asia as we know it today. What we have seen in recent years is a clear effort to improve the regulatory environment for investors.

For China, where much of the world’s attention is focused, the key moment of this policy development occurred in October 2020, when the central government banking regulators (CBRC) blocked the planned listing of payments and lending business, Ant Group, owned by Chinese technology giant Alibaba. Further central government reforms targeting anti-competitive behavior in the technology, online retailing, food delivery and the education sectors, plus over lending in the real estate sectors, occurred over the following 2 years to 2023.

Regulatory reform specifically targeting capital markets have accelerated since 2023, with the China Securities Regulatory Commission (CSRC) given stronger powers to tighter scrutiny over IPO’s, financial institutions, and capital market supervision, with a clear focus on regulating Chinese equity markets to make them a safer destination for local Chinese investors. Many commentators continue to misread the post-Alibaba period of heavy-handed central government led regulatory restructuring as negative for Chinese capital markets, but we think it has created a safer and more attractive environment for investors.

There are several high-quality global leaders in the region which have attractive valuations, a high-growth outlook and global/regional industry dominance. 3 noteworthy examples from the multitude Asian companies at the forefront of technological innovation include:

BYD (1211 HK) – the world’s largest EV manufacturer (China)

- China domestic EV market was >50% of annual global EV sales over the past 5 years.

- BYD is expected to produce 4.4 million EV’s in 2025 and sells into 50 countries, driven by subsidized replacement of ICE vehicles with EV’s.

- BYD recently announced plans to expand EV manufacturing into Brazil, Hungary, Thailand, raising planned capacity above 8 million vehicles per year within the next 3-5 years.

- Trading at a FY 25 P/E of 12x, a 72% discount to its 5-year avg P/E, and 73% discount to Tesla’s FY 25 P/E

- 40% discount to average Bloomberg analyst price target of HK$285

Samsung (005930 KS) – the world’s largest memory semiconductor maker (Korea)

- Samsung shipped 60.1 million of handsets in Q1 2024 versus 50.1 million for Apple with the release of AI-enabled S24 Galaxy handset being a key driver. [viii]

- Samsung is also the world’s largest DRAM and NAND Flash memory chip maker, with 40% and 31% global market share respectively.

- Samsung’s new HBM3E DRAM memory chips, which have a combined 95% global market share with Korean rival SK Hynix, are critical to powering NVIDIA’s new GPU AI-chips.

- Trading at 5.2x FY24 EV/EBITDA, a 72% discount to Apple and 50% discount to TSMC.

- 22% discount to average Bloomberg analyst 12/24 price target of KRW103,000.

Resonac – the world’s largest semiconductor chemical and gases provider (Japan)

- Diversified specialist chemical producer focused on chemicals and inert gases critical to the manufacture of semiconductors.

- Global leader in critical inputs for semiconductors, including solder resist, copper-clad laminates, thermal interface materials and nonconductive film.

- Trading at ~6x FY24 EV/EBITDA, a 32% discount to the 8.8x average of its Asian specialty chemical peers.

- 17% discount to average Bloomberg analyst 12/24 price target of ¥4,000.

At Carrara, we access these major global themes by investing in Asian companies that are critical to the supply chain for many better-known US and European firms. For example, ~80% of Apple’s iPhones are assembled at Foxconn’s mega-plant in Zhengzhou, China. The world’s second largest company, Nvidia, relies almost solely on Taiwan Semiconductor Manufacturing Company (TSMC) plants across Asia to produce its graphics processing units (GPU’s). Finally, the global shift to clean energy and transportation would be orders of magnitude more difficult if isolated from Asia given China’s dominance in critical minerals and solar cell manufacturing, where it controls over 70% of global production.

From a valuation perspective, Asian equities look particularly attractive relative to global counterparts and their own historic levels in both stock price and relative to earnings. The consensus forward P/E for Japan’s TOPIX index is ~16x. for Hong Kong’s Hang Seng Index it is 10x. This compares to a P/E ratio of ~25x for the US S&P 500 Index and ~20x for Australia’s S&P/ASX 200 Index.

For further information on valuations in China relative to US counterparts specifically, consider ‘Is It Time to Re-Enter Chinese Equities?’

Is Now the Time to Invest?

Though we are of the opinion that the long-term fundamental thesis for investing in Asia is strong, now is a particularly attractive time to allocate.

Fund Flows

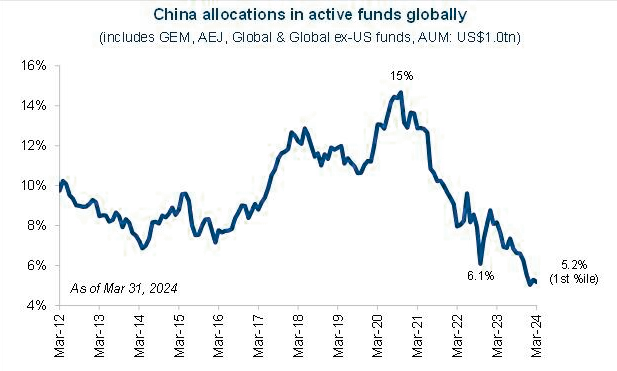

China is institutionally under owned, and investors need to buy stocks – according to Goldman Sachs (based on EPFR data), mutual funds globally in aggregate only had 5.2% allocated to Chinese equities as of end-March, which is just 1/3rd of their allocation in 2020, despite a 37% decline in the Hang Seng index valuation over the past 3 years.

Recent accelerating fund flows into Hong Kong suggest we are in the early stages of a substantial reallocation of institutional capital back into China and greater Asia, driven by the need to rebalance portfolio weightings back towards their benchmark indices.

Portfolio Diversification

Many investors are only invested domestically and have limited exposure to large cap developed market companies, primarily focused on technology. Asian markets have very different drivers both fundamental and from a market technical perspective and could offer investors diversity and portfolio benefits in terms of both risk and return. Accessing the supply chain for many global companies, predominantly in Asia, can also take some of the volatility out of investing in the end-product company which may be more sensitive to the economic environment or profit margins.

Conclusion

Carrara is globally focused and currently sees Asia as the most attractive investment destination in the world. We also think that increased exposure to the region can offer investors portfolio diversification, exposure to the strongest economic region in the world and access to global leaders in key industries.

An active approach is essential because of the divergence in returns for Asian asset markets and the increased scope for excess returns. Having first invested in Chinese equities in 2003, our Portfolio Manager Tim Davies is one the most experienced thought-leaders in the industry with expertise including semi-conductors and electric vehicles.

A nimble approach is key when investing in Asia to both counter the inherent volatility in these markets and media biases that impact news-driven algorithms (and hence capital flows.) Managing an absolute return style affords us the ability to dynamically alter exposure, actively hedge risk when deemed appropriate, and take advantage of market mispricing.

Due to its diversified nature and absolute return objective, Carrara’s approach may be a way to access the likely excellent opportunity in Asia over the coming years.

If you would like more information about our investment views, how we are investing in Asian markets or how you could become an investor, please contact us.

Citations

[i] “Asia Population” World Prospects 2022. United Nations. Date as per 23 January 2023

[ii] The rise of Asia’s middle class | World Economic Forum (weforum.org)

[iii] https://www.morganstanley.com/ideas/global-macro-economy-outlook-2023

[iv] https://fortune.com/asia/2024/01/19/byd-launches-indonesia-new-cars-factory-ev-global-expansion/

[v] https://timesofindia.indiatimes.com/city/delhi/hyundai-invests-4bn-to-expand-car-production-in-india/articleshow/106911900.cms

[vi] Asia-Pacific Trade and Investment Trends 2023/24. Foreign Direct Investment Trends and Outlook in Asia and the Pacific

[vii] https://ammoniaenergy.org/articles/ocior-energy-twin-million-tonne-per-year-projects-in-india/#:~:text=UAE%2Dbased%20Ocior%20Energy%20will,renewable%20ammonia%20projects%20in%20India.

[viii] IDC Mobile Phone Traver, 14 April 2024