Key Points

The Time Has Come

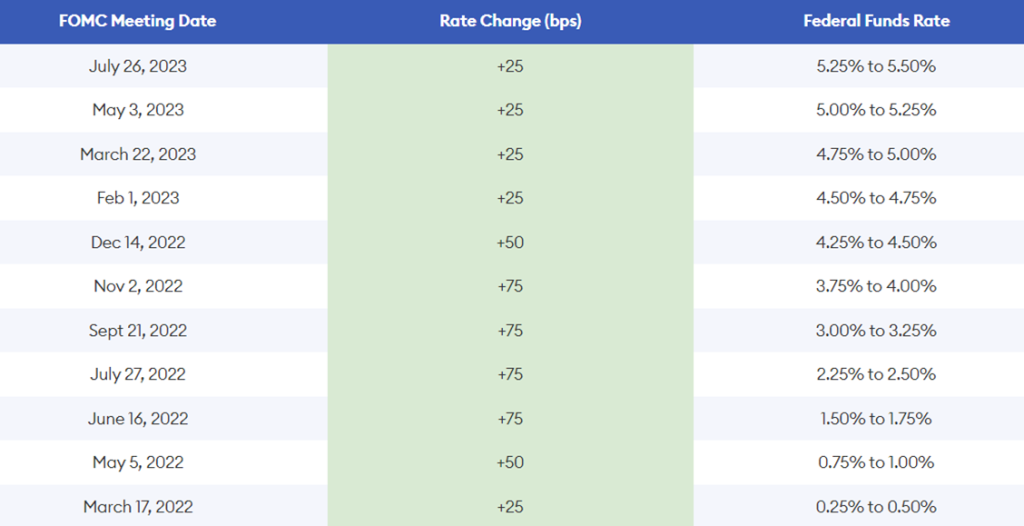

The last time the Fed cut rates was in March 2020, when it cut twice – firstly on the 3rd of the month by 0.50%, and again on the 16th by 1.00%, in response to Covid. Once the Covid crisis had passed, it began raising rates consistently for 18 months beginning on 17th March 2022 (as shown in the table below) in response to a rapid increase in inflation, primarily resulting from Covid related supply chain disruptions.

At the Economic Policy Symposium held in Jackson Hole, Wyoming on 22nd-24th of August, Fed Chair Powell said, “Inflation has declined significantly. The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic.” Importantly, he also said “The time has come for policy to adjust.” In prior speeches and post-FOMC press conferences, Powell had suggested the timing of a rate cut was near, but this time he was explicit, saying that rates would be cut at the September meeting.

Last Sequence of Fed Rate Hikes

The path forward on setting the appropriate interest rate level is unlikely to be easy for the Fed as it balances inflation, the labour market and economic growth. The market is behaving as if everything will run smoothly, however:

Market Expectations

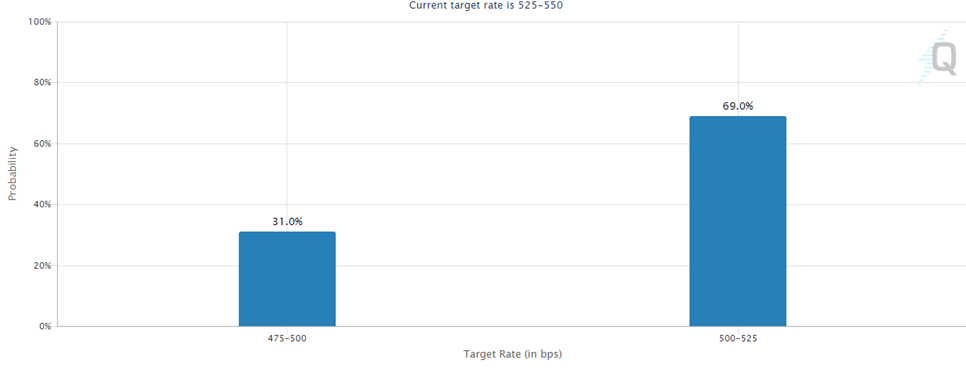

Current market pricing is for a 0.25% cut in September 2024 with an outside chance that it could be 0.50%.

Federal-Funds Rate Target Expectations for 18th September 2024 Meeting

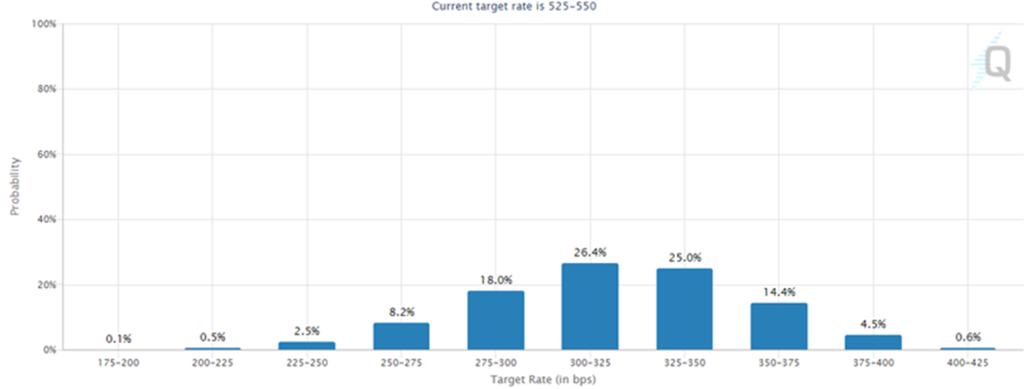

Beyond September 2024, the futures market is pricing in a total of 2.00% of cuts in the next 12 months.

Target Rate Probabilities for 10th December 2025 Meeting

We agree with the consensus that a smaller cut of 0.25% is likely. We would be concerned if the Fed cuts by more given the potential for the US dollar to sell off and cause problems for the broader financial markets. There are two potential problems here:

If the US dollar weakened significantly, we would likely see a rise in other currencies, including the Japanese Yen. This may risk a repeat of the global equity selloff in early August (caused largely by the unwind of the Yen carry-trade after the Bank of Japan (BoJ) hiked interest rates). Although it is not technically the Fed’s job to manage FX risk and its impact on equities, we do not expect that they want financial market volatility given the impact on the economy, confidence, and tax revenues if investors lose money.

A weaker US dollar risks causing a rise in the Chinese Yuan, which would be counter to the People’s Bank of China (PBOC) desire for a weaker currency, which it wants to benefit Chinese exports – especially given increased tariffs by several Western nations. This could put further pressure on the US / China relationship and lead to further selling of US dollar assets such as Treasury bonds. Decreased demand for Treasuries could in turn put upward pressure on US market yields which would be counterproductive to the Fed’s rate cuts.

Investment Implications

Investment markets seem somewhat complacent until last week, heading into such a major event with little risk being priced into markets – especially the risk of a US recession if the labour market continues to deteriorate. As such, while we think there are some excellent investment opportunities currently available, we are not allocating capital simply on the basis that the Fed is going to cut rates – in fact, we think that much of this benefit is likely already priced into markets given expectations.

Bonds

Bonds are traditionally major beneficiaries from an environment in which a central bank cuts rates. However, with US 10-year bond rates currently trading at 3.71%, government bond yields do not look overly attractive, especially given the potential for inflation to tick back up and the incremental yield that can be earned in high quality corporate credit – particularly in the domestic Australian market.

Commodities

We are big believers in the outlook for commodities and think that we could be in the very early stages of a commodity super-cycle, given:

- Supply/demand imbalances for several key commodities (including copper and nickel) in the shift to clean energy

- Rising long-term economic growth forecasts in emerging markets including India, Vietnam, and Indonesia

- The potential for inflation to reaccelerate given growing government deficits (funded through higher debt issuance), coupled with increased infrastructure spending and large stimulus packages targeted at reshoring of manufacturing (e.g. US$280bn Semiconductor CHIPS and Science Act)

This environment, in conjunction with lower interest rates (and hence the cost of funding) should be a supportive environment for commodity prices.

Gold

Gold should continue to appreciate in our view due to rising global government debt balances as outlined above. Central bank demand for gold is growing as some central banks avoid recycling US dollars back into US assets such as Treasuries. Further, gold’s use as a medium of exchange for trade among several countries is slowly rising, especially those in the BRICS+ alliance which want to reduce US dollar trade dependence but do not necessarily want to carry the added risk of holding volatile emerging market’s currencies in their reserve balances. With gold up 21% YTD, its near-term upside could be limited, but over the medium term, rising global government deficits, easing US monetary and fiscal policy, and rising scarcity suggest it could appreciate much higher over the medium to long-term.

Equities

In terms of equities, we think emerging markets stocks should benefit from lower US interest rates, especially those in Asia (ex-Japan), as global liquidity increases and capital flows look for opportunities outside of the US with more attractive growth and valuations. These markets have been unloved for many years, and we think they present a tremendous opportunity given the economic growth in the region, the demographic shift towards the middle class, and more cohesion with BRICS+ and the Belt and Road initiative. Global investors, including Australians, are typically underinvested in the region and as a result, high quality companies can be found at very attractive valuations relative to their cashflow and earnings.

US equities may benefit from falling domestic interest rates, but elevated market valuations suggest the benefits of Fed easing may have already been priced in. We continue to appreciate US technology, given the companies are global leaders in a revolutionary period of AI development, they are highly cashflow generative and have few competitors. That said, we think there may be an opportunity to enter or add to global US tech leaders over the next 6-12 months if markets react negatively to US economic growth concerns. One sector that we are avoiding is the US consumer, which is highly indebted and stressed as per recent data and US earnings calls.

Conclusion

Overall, we think the coming 3-6 months should provide a range of investment opportunities as it is unlikely that the Fed’s path of rate cuts and the US economy will be as smooth as current market pricing would suggest.

We expect periods of heightened volatility, and this means that it will be important to actively manage risk and to be pragmatic with capital management to take advantage of opportunities as they arise.

We welcome any further discussions of our thematic ideas, stockholdings, or macro thinking – please contact us for more information.