With aggressive monetary stimulus well behind us, the first half of 2024 is starting to show some stark changes in credit markets from this time last year. Although liquidity is slowly leaving the system, pricing would indicate this isn’t happening uniformly as capital is being reallocated amongst credit classes. This note provides recent observations across public and private credit markets and offers insights for investors considering the space.

Public Markets

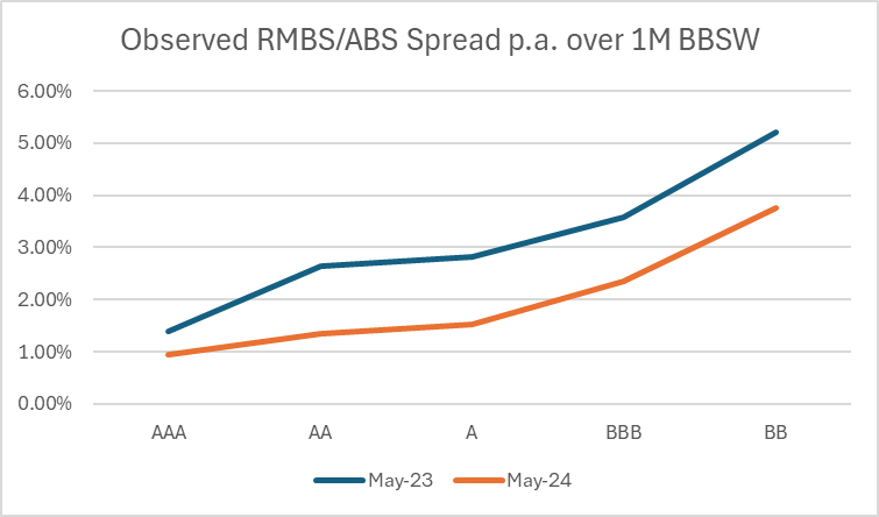

Over the last few months there has been a dramatic compression in spreads across residential mortgage-backed security (RMBS) and asset-backed security (ABS) primary market. New issuances have tightened more than 1.00% p.a. from this time last year for all rating bands below AAA.

This compression in spreads is partly due to increased demand because of the proliferation of less regulated credit vehicles which aren’t subject to the Australian banks’ prudential standard restrictions – this standard (APS 120), makes it uneconomic for banks to hold securitisations below a ‘AA’ rating.

Limited quality supply could also be contributing to the compression in spreads, with major banks running down their outstanding securitisation balances over the last few years, albeit non-ADI issuers are working hard to fill that shortfall. We expect over the coming months that increased supply (already starting in 2024) prompted by attractive issuance markets is shifting the balance to potentially wider spreads.

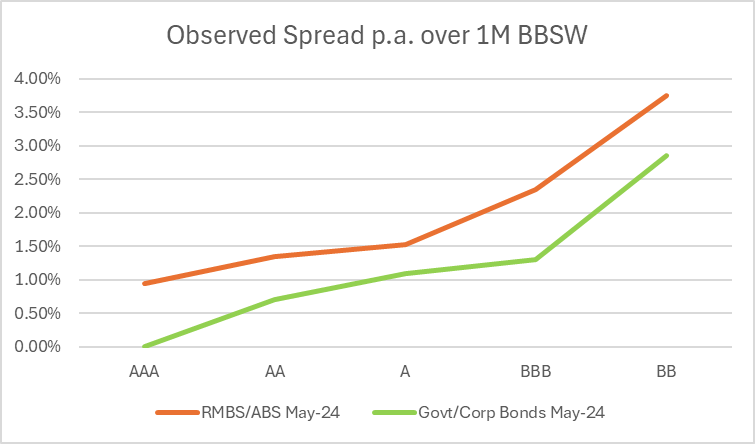

Having said this, current RMBS/ABS spreads still appear to be offering a significant premium over similarly rated government and corporate bonds.

Many investors seeking yield from commoditised product sought out Australian Bank Tier 2 Capital Notes (T2). As a result of APRA’s impetus to bolster banks’ capital buffers, S&P announced an upgrade to Australia’s Banking Industry Country Risk Assessment in April which flowed through to one-notch upgrades in almost all banks – with the Big 4’s T2 being upgraded from ‘BBB+’ to ‘A-‘. These higher ratings allow the banks to reduce the interest rates paid on these notes, leaving some investors seeking other avenues for yield.

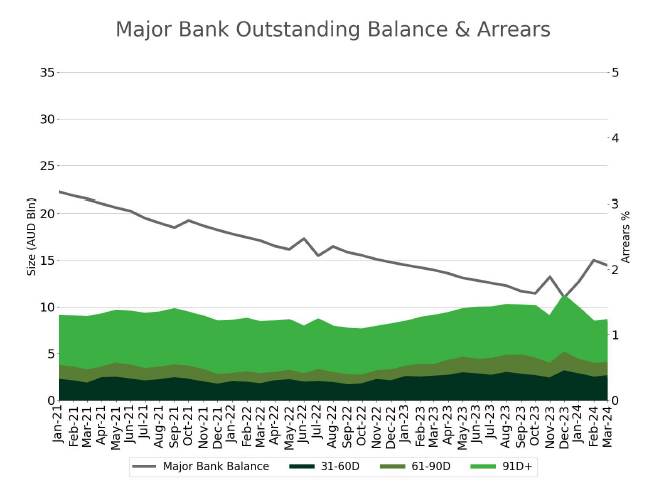

Consumer credit appears to be holding up very well despite cost-of-living/inflationary pressures, with arrears at similar levels to this time last year. We expect this to be sustainable so long as unemployment remains low.

Private Markets

In pockets of the credit markets, specifically construction and non-luxury SME subject to discretionary spending, we are seeing increases in administration and disposals of secured assets by receivers. In the near term we expect these markets to remain problematic as borrowers look to roll their funding obligations and lenders become more scrupulous of these stressed sectors.

These events are not ignored in better performing credit markets and investors are being more cautious with how they allocate their capital in private markets, keeping funding levels at or above those observed last year. This is where Carrara see the current opportunity, namely good quality assets tainted by the contagion within their sector.

Flexibility and Diligence

Manifestly mandate restrictions are driving significantly varied pricing between similarly rated credit assets. This can prove frustrating for those constrained in their allocation, however, as with most inefficiencies, has the potential to be exploited.

Armed with the flexibility to allocate amongst a wide array of credit exposures along with the expertise to understand the specific aspects of these differing asset classes, one could reasonably expect to outperform, over the medium term, by investing where the dominant weight of capital is not.

The Carrara Credit Portfolio has been able to take advantage of relatively wide spreads in the public credit space over the last 18-months, but as these spreads have become compressed our focus has been slowly shifting to the more attractive returns for risk offered by some of the offerings in the private credit market.

If you would like more information about our investment views in the current market climate, Carrara’s approach to credit investment, or how you could become an investor, please contact us.

Citations

[i] ‘Major Bank Outstanding Balance & Arrears’, p. 3, Bloomberg Australian Structured Finance Review Q1 2024